LITC Volunteer Information

Low Income Tax Clinic

Low Income Taxpayer Clinics (LITC) assist low income individuals who have a tax dispute with the IRS, and provide education and outreach to individuals who speak English as a second language (ESL).

LITCs are independent from the IRS and the Taxpayer Advocate Service (TAS). LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. LITCs can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court. LITCs can also help taxpayers respond to IRS notices and correct account problems.

In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language.

KYCC’s LITC Program ensures the fairness and integrity of the tax system for taxpayers who are low-income or speak English as a second Language (ESL) by:

- Providing pro bono representation on their behalf in tax disputes with the IRS;

- Educating them about their rights and responsibilities as taxpayers; and

- Identifying and advocating for issues that impact these taxpayers.

Online LITC Volunteer Application

KYCC is actively recruiting and seeking volunteers for the following positions:

- Experienced CPA/EA with PTIN – Some taxpayers with controversies need to file prior-year tax returns in order to be currently compliant to be eligible for collection alternatives. Also, survivors of domestic violence taxpayers often need to file a competing Married Filing Separate (MFS) return in response to an invalid Married Filing Joint return filed by the Abuser. Remote/In-person. 10 – 15 hours.

- Experienced Controversy Practitioner with a CAF # and Bilingual (Korean/English or Spanish/English). We are seeking volunteers experienced with administrative relief and appeals. If you have experience calling PPS/Collections/IVO to unravel and ‘diagnose’ taxpayer issues and volunteers to help taxpayers during “Problem Solving Day” events held quarterly at KYCC. This volunteer opportunity does not require signing a 2848 or continued representation. Remote/In-person. 1 day per quarter.

- Experienced Tax Attorney / USTC Practitioner admitted to practice before the Tax Court. We are seeking volunteer pro bono counsel to assist with Virtual Settlement Day at the Los Angeles trial calendar locations. This volunteer opportunity does not require signing a 2848 or continued representation. Assuming the taxpayer meets our grant guidelines and criteria, the clinic may continue representation and the volunteer could also mentor the clinic if it enters an appearance. Remote/In-person. 1 – 2 afternoons per month.

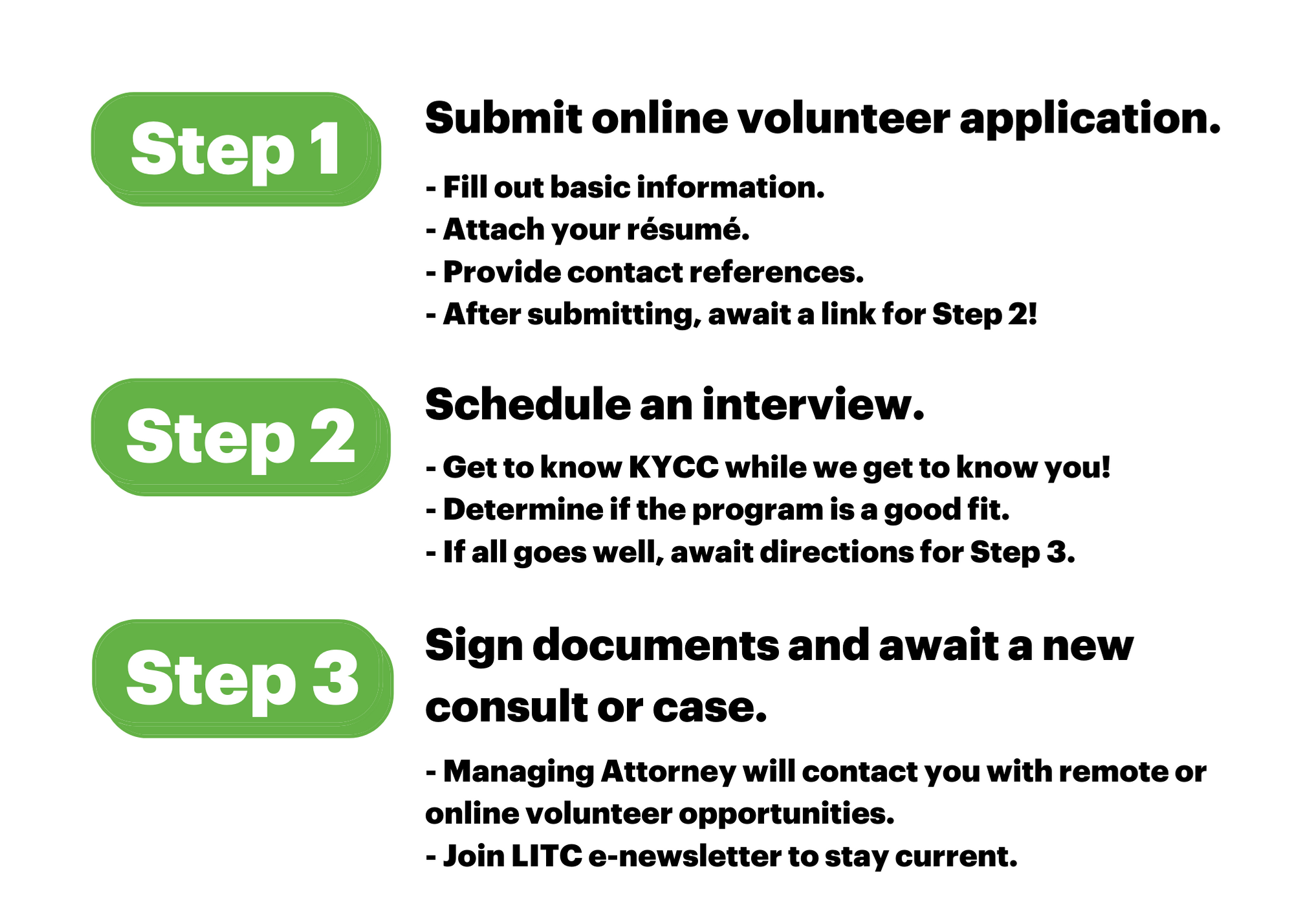

What does the process of becoming a KYCC LITC volunteer look like?